How I Got Banned From Sports Betting (Using Maths)

The email arrived innocuously enough, nestled between junk mail and a newsletter I'd forgotten I subscribed to. "Account Update," the subject line read. It wasn't an update; it was a eulogy. My account with Sportsbet was being restricted. Severely. Maximum bets reduced to $10, promotions revoked. It wasn't the first, and I knew it wouldn't be the last. The reason? Unstated, of course, but I knew exactly why. I wasn't gambling; I was calculating. I was an arbitrage bettor, and I was systematically extracting guaranteed profit from their odds. I was using maths to beat the house, and the house, inevitably, was kicking me out.

This isn't a story of epic wins fuelled by gut feelings or insider tips. It's a story about exploiting mathematical inefficiencies in a system designed to profit from the opposite. It's the story of how I, armed with spreadsheets, multiple browser tabs, and a healthy dose of caffeine, turned sports betting from a game of chance into a (temporary) source of near-certain income, and how that journey inevitably led to getting banned. This is the story of arbitrage betting.

The House Always Wins... Usually: Understanding Bookmaker Margins

Before diving into the 'how', it's crucial to understand why most people lose money betting on sports. It's not just bad luck or poor predictions. It's baked into the system. Bookmakers don't offer 'fair' odds. They build in a profit margin, often called the 'vigorish' or 'vig', 'juice', or 'overround'.

Imagine a simple coin toss. Fair odds would be 2.00 for heads and 2.00 for tails. Bet $100, win $100 profit. A bookmaker, however, might offer odds of 1.91 for heads and 1.91 for tails.

Let's see what happens. If they take $100 in bets on heads and $100 on tails (a total of $200), no matter the outcome, they only pay out $191 ($100 stake + $91 profit) to the winners. They keep $9 ($200 taken - $191 paid out). This $9 is their guaranteed profit, their margin.

This margin exists on every market they offer, from football matches to tennis games to political elections. By slightly shaving the odds on all possible outcomes, they ensure that over the long run, across millions of bets, they turn a profit regardless of individual results. They aren't betting against you; they're balancing their books and collecting the commission. The average bettor, even one who wins occasionally, is fighting against this built-in disadvantage.

Enter Arbitrage: The Mathematical Loophole

Arbitrage, in finance, means exploiting price differences in different markets for the same asset to make a risk-free profit. Sports arbitrage betting applies the same principle to betting odds.

Different bookmakers compete for customers. They set their own odds based on their analysis, liabilities (how much money they've taken on each side), and desired margin. Crucially, they don't always agree. Sometimes, the discrepancies in odds between different bookmakers create a situation where you can bet on all possible outcomes of an event across these different bookies and guarantee a profit, no matter what happens.

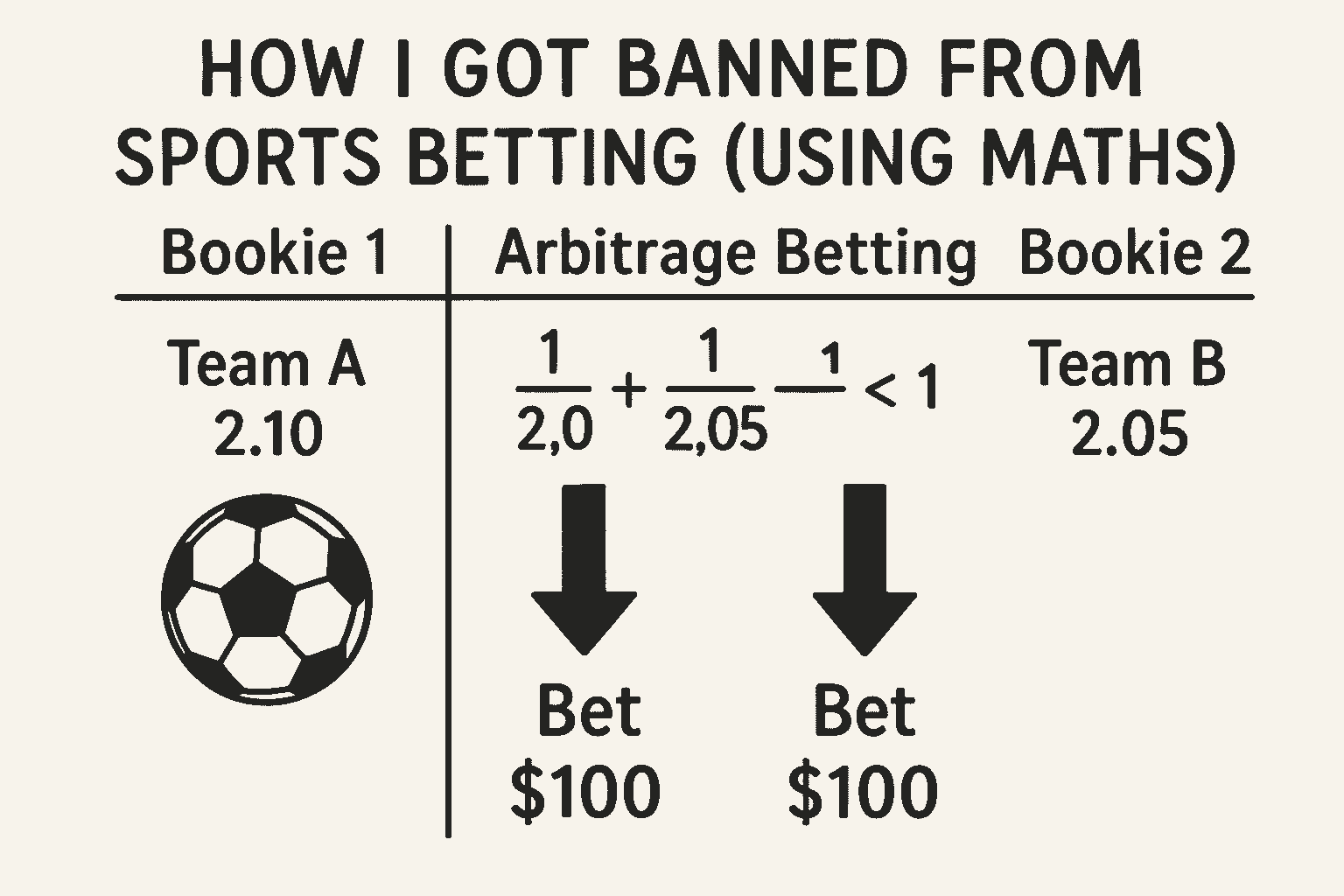

Arbitrage betting exploits the differences in odds between bookmakers, allowing you to profit regardless of the outcome by betting on all possible results.

This occurs when the implied probabilities of the best available odds for all outcomes add up to less than 100%. Remember the bookie's margin makes the probabilities add up to more than 100%? An arbitrage opportunity (or 'arb') is the inverse – a scenario where the combined odds represent less than a 100% probability, meaning the bookmakers, collectively, have left a gap for guaranteed profit.

A Simple Arbitrage Example: The Tennis Match

Let's imagine a tennis match between Player A and Player B.

- Bookie A offers odds of 2.10 for Player A to win.

- Bookie B offers odds of 2.05 for Player B to win.

How do we know if this is an arb? We convert the odds to implied probabilities:

- Implied Probability = 1 / Decimal Odds

- Bookie A (Player A): 1 / 2.10 = 0.4762 (or 47.62%)

- Bookie B (Player B): 1 / 2.05 = 0.4878 (or 48.78%)

Now, add the probabilities: 47.62% + 48.78% = 96.40%

Because this total is less than 100%, an arbitrage opportunity exists! The gap (100% - 96.40% = 3.60%) represents the guaranteed profit margin on our total stake.

Unlike traditional betting where you hope for a specific outcome, arbitrage betting guarantees a profit regardless of what happens, making it a mathematical certainty rather than a gamble.

Calculating the Stakes:

Okay, so there's an arb. How much do we bet on each player to guarantee the profit? Let's say we want to invest a total of $1000.

Finding arbs manually is extremely difficult in today's fast-moving market. That's why tools like our automated dutching finder are essential - it scans multiple bookmakers simultaneously to identify arbitrage opportunities in real-time before they disappear.

The Result: Regardless of who wins the tennis match, by placing these calculated stakes at the respective bookmakers, we invest $1000 and are guaranteed a return of approximately $1037.30 - $1037.40. That's a guaranteed, risk-free profit of around $37.35, or 3.735% return on investment, just for spotting the discrepancy and placing the bets.

These calculations can be complex, especially with multiple outcomes. That's why we've built our dutching calculator that automatically determines the optimal stake for each outcome to guarantee equal profit no matter what happens.

My Journey into the Arb World

I stumbled upon arbitrage betting not through some grand revelation, but through a combination of a mathematical inclination and frustration with traditional betting. I enjoyed the analysis of sports, but the inherent house edge felt like an insurmountable barrier to consistent profit. Reading online forums and financial articles, the concept of arbitrage clicked. It transformed betting from a guessing game into an exercise in data comparison and swift execution.

With arbitrage betting, your edge isn't luck or sports knowledge—it's spotting mathematical inefficiencies faster than the market can correct them.

The initial steps were tentative. Manually scanning odds comparison websites, trying to spot these fleeting opportunities. Arbs rarely last long – bookmakers quickly adjust odds that are out of line. My first successful arb was tiny, maybe a 1.5% return on a $100 total stake. A $1.50 profit. It sounds insignificant, but the feeling was electric. It wasn't a win based on luck; it was earned through calculation.

Quickly, I realised manual searching wasn't scalable. The real game involved:

- Arbitrage Software/Alert Services: These tools constantly scan dozens, even hundreds, of bookmakers' odds across thousands of markets, flagging potential arbs in real-time. They do the heavy lifting of finding opportunities.

- Multiple Bookmaker Accounts: You need accounts with as many bookmakers as possible, funded and verified. An arb might exist between Bookie C and Bookie Z; you need access to both. This meant going through numerous KYC (Know Your Customer) processes – submitting IDs, proof of address, bank statements.

- Sufficient Bankroll: While individual arb percentages are small (typically 1-5%, sometimes less), profit comes from volume and larger stakes. You need enough capital spread across various bookies to place meaningful bets quickly.

- Speed and Accuracy: When an arb appears, you have minutes, sometimes seconds, to verify the odds, calculate stakes using an arb calculator and place both (or more, for multi-way arbs) bets before the odds change. A single mistake – wrong stake, wrong market, delay – can turn a guaranteed profit into a potential loss.

My routine became a blur of browser tabs, login screens, and rapid-fire calculations. An alert pops up: 2.8% arb on an obscure Eastern European basketball league handicap market between Bookie X and Bookie Y. Verify odds. Calculate stakes: $357.14 on Bookie X, $642.86 on Bookie Y. Place bet 1. Place bet 2. Confirmation received. Breathe. Move on to the next.

It felt less like betting and more like high-frequency trading, albeit on a much smaller, manual scale. The profits started accumulating. Not life-changing amounts initially, but a steady, consistent trickle that grew as my bankroll and efficiency improved. It was intellectually stimulating, finding these cracks in the system.

Sign up for a free account

Sign up for an Outmatched account and gain access to our comprehensive matched betting tools, calculators, and community support.

Why Bookmakers Hate Arbers (And How They Catch You)

Bookmakers are businesses designed to profit from the average bettor who bets recreationally and, statistically, loses over time due to the vig. Arbitrage bettors completely disrupt this model:

- Guaranteed Loss (for one bookie): Every successful arb means at least one of the involved bookmakers is offering odds that guarantee they will lose money on that specific market if the arber covers all outcomes.

- Not Recreational: Arbers don't behave like typical punters. They bet on obscure markets, use unusual stake sizes (like $357.14 instead of a round $100 or $500), and often snap up odds moments after they appear, especially if they are 'mispriced'.

- Value Extraction: Arbers consistently take 'value odds' – odds that are mathematically higher than the true probability, even accounting for the vig. Bookies want bettors taking the other side, the side with poor value.

Bookmakers invest heavily in risk management systems and algorithms to detect behaviour patterns associated with arbitrage:

- Stake Size: Betting precise, unrounded amounts calculated by arb software is a huge red flag.

- Market Choice: Consistently betting on obscure leagues or specific bet types (like Asian Handicaps) where arbs are more common.

- Speed: Always taking the peak odds just before they drop.

- Betting Patterns: Only betting when mathematically advantageous odds are available, rather than betting consistently on favourite teams or events.

- IP Address/Device Linking: Attempting to use multiple accounts from the same device or IP can link them.

- Withdrawal Patterns: Consistent small profits and frequent withdrawals can raise flags.

The Inevitable Ban Hammer: Gubbing and Closures

My first restriction wasn't an outright ban. It was a 'gubbing' – industry slang for having your stakes severely limited. The email from Bookie A was the beginning of the end for that account. My maximum bet on most markets dropped to something trivial, like $10. Promotions vanished. The account was effectively useless for arbing.

Why not just close the account? Sometimes they do, but often they prefer to keep the account open but neutered. Perhaps it's data collection, perhaps it avoids arguments, or maybe they hope you'll revert to unprofitable recreational betting out of frustration.

One by one, over several months, the emails arrived from other bookmakers. Some were subtle stake restrictions, others were blunt closures citing "trading concerns" or "business decisions." Each one stung a little, not financially (the profit was already banked), but because it represented a door closing, a reduction in the available pool of odds to exploit.

The process felt like a slow strangulation. The number of viable bookmakers dwindled. Finding arbs became harder, requiring more obscure bookies, often with lower limits or less reliable platforms. The 'easy' money dried up. The cat-and-mouse game was nearing its conclusion, and the house, as it almost always does, was winning the war, even if I'd won several battles.

Is Arbitrage Betting Still Possible Today?

Yes, but it's significantly harder than it once was.

- Smarter Bookies: Algorithms are faster, margins are tighter, and odds corrections are almost instantaneous. Large, obvious arbs are rare.

- Aggressive Account Restrictions: Bookmakers are quicker to limit or close accounts exhibiting arb patterns. KYC procedures are stricter, making multi-accounting riskier.

- Lower Margins: The average arb percentage has decreased. You need a larger bankroll and higher turnover to make meaningful profits.

- Software Costs: Reliable, fast arb software requires a subscription fee, eating into profits.

- Execution Risk: The risk of odds changing after you've placed one side of the arb (leaving you exposed) is ever-present. Bookmaker errors (voiding bets) can also wipe out profits.

It requires more dedication, more capital, faster reactions, and a greater tolerance for account closures than ever before. It's less of a casual side hustle and more of a demanding, high-pressure task.

Finding arbitrage opportunities manually is virtually impossible in today's fast-moving markets. That's why our automated dutching finder is so valuable - it scans multiple bookmakers simultaneously to identify arbs in real-time, calculating the optimal stakes before the opportunity disappears.

Reflections on the Arb Life

My journey into arbitrage betting was fascinating. It was a practical application of mathematics in a real-world scenario, proving that yes, you can beat the bookies, at least for a while. It required discipline, speed, and a cool head under pressure.

Was it worth it? Financially, yes, it provided a decent supplemental income stream for a period. Intellectually, it was stimulating. But it wasn't passive income. It demanded constant attention, screen time, and the low-level stress of managing multiple accounts and executing bets flawlessly against the clock.

Getting banned wasn't a surprise; it was the expected outcome. You're playing a game where the rules explicitly state (in the T&Cs you agree to) that the house can kick you out for winning too smartly. Arbitrage betting isn't illegal, but it violates the spirit of the 'recreational use only' clause buried in most bookmaker agreements.

So, while the maths guarantees profit if you can place the bets, the practical reality is a constant battle against detection and restriction. I learned a lot about odds, probabilities, and the inner workings of the betting industry. And I learned that even when you use maths to find a guaranteed win, the house ultimately finds a way to stop you from playing. The emails stopped arriving eventually, mainly because there were few accounts left to ban. The arb game, for me, was over.

If you're interested in learning more about mathematical approaches to betting, consider reading about positive EV betting, matched betting, or how to withdraw free bets. For those ready to try these strategies, our odds matcher tool and dutching tool can help you identify potentially profitable opportunities automatically.

Discord Server

Connect with other matched bettors, get help with offers, and stay updated with the latest strategies.

Join Discord